Sona BLW Precision Forgings Limited has become one of the most strategically located automotive technology companies in India which have been situated at the intersection of precision engineering, electrification and moves to global mobility trends. In contrast to the traditional auto components manufacturers that continue to be heavily reliant on the internal combustion engine (ICE) demand, Sona BLW has progressively shifted its product lines to electrified and technology-focused products to enable it to engage effectively in the global switch towards electric and hybrid vehicles. The company has received a lot of attention from investors over the past few years because of its robust growth in profits, the growing market share globally, and the growing exposure to EV platforms. This article will provide complete information about Sona BLW Share Price.

Sona BLW Precision Forgings Ltd Company Overview

Sona BLW Precision Forgings Ltd is an Indian based automotive technology and systems manufacturer and exporter that develops, produces and distributes high precision components and assemblies that are applied in a very large variety of types of vehicles. The company products include passenger car, commercial cars, two-wheeler cars, off-highway cars, and electric cars and it is serving the major global original equipment manufacturers (OEMs).

The activities of the company are not limited to mechanical parts. In the long-term, Sona BLW has developed the capacity in electrical system, embedded electronics, control software and application software that allows it to provide integrated solutions as opposed to isolated components. This has assisted the company to climb the value chain and minimise the risk of commoditisation.

| Item | Details |

| Company Name | Sona BLW Precision Forgings Ltd |

| Sector | Automobile & Auto Components |

| Current Share Price | ₹532 |

| Market Capitalisation | ₹33,110 Cr |

| Face Value | ₹10 |

Product Portfolio and Technology Depth

The portfolio of products offered by Sona BLW is designed in a manner that it can be relevant in the context of the different drivetrain technologies. The company has a worldwide innovation in accuracy forged bevel gears and differential assemblies that are in both ICE and electric vehicles. This two-fold functionality offers sustainability amid the change process of the car sector.

Another product besides parts of the drive train involves the production of starter motors, micro-hybrid motors, belt starter generators (BSG), traction motors, as well as intermediate gears. Its EV traction motor division has become of special significance as OEMs make more vehicle types increasingly electrified. Sona BLW was estimated to have market share of 8.1 percent in the global market in the calendar year 2023 in differential gears and 4.2 percent in starter motors, which is a good competitiveness in the global market.

| Segment | Key Products |

| Drivetrain Components | Differential gears & assemblies |

| Motors | Starter motors, traction motors |

| Hybrid Systems | BSG & micro-hybrid motors |

| EV Components | Traction motors, gears |

| Software | Embedded & application software |

Industry Landscape and Competitive Position

Globally, the auto components industry is experiencing a structural change that is fuelled by electrification, emissions, lightweight, and digital integration. The suppliers with no EV exposure or reliance on ICE only are at risk of demand in the long run. Sona BLW has taken the initiative to re-brand itself as a technological mobility provider, and an increasing portion of revenues are associated with EV and electrified platforms. The company is higher margin and better growth visible than many of its peers, but at premium valuation multiples.

| Company | CMP (₹) | P/E | Market Cap (₹ Cr) | ROCE |

| Samvardhana Motherson | 132 | 39.7 | 1,39,815 | 13.7% |

| Bosch India | 36,495 | 46.6 | 1,07,630 | 21.1% |

| Bharat Forge | 1,727 | 70.7 | 82,537 | 12.2% |

| Uno Minda | 1,251 | 62.4 | 72,250 | 18.8% |

| Sona BLW | 532 | 50.8 | 33,110 | 17.8% |

Sona BlW Share Price 2026–2030 Outlook

Sona BLW Precision Forgings is projected to enjoy a growth in electric vehicle (EV) adoption across the globe, a growth in exports, and a growth in advanced drives train technologies between the year 2026 and 2030. Analysts estimate that revenue will grow at a consistent rate of about 1015% CAGR, with high levels of order inflow of global OEMs, and emphasis of EV components including differential assemblies and motor solutions. Although valuations can be sustained at premium levels because of expectations of growth, risks such as fluctuation in the price of raw materials, economic recession around the world, and competitions might cause a short run fluctuation. In general, the long-term picture is optimistic when the company is able to stabilize the margins and proceed with technological innovation.

| Year | Expected Price Range (₹) | Growth Drivers | Key Risks |

| 2026 | 520 – 1126 | EV demand, export growth | High valuation, market volatility |

| 2027 | 650 – 1300 (est.) | Global OEM partnerships | Input cost pressure |

| 2028 | 800 – 1600 (est.) | Technology expansion | Competition |

| 2029 | 950 – 1900 (est.) | Market share gains | Global slowdown |

| 2030 | 1100 – 2438 | Strong EV penetration | Execution risk |

Sona BLW Share Price History

In June 2021, Sona BLW Precision Forgings was listed at a premium of 363 which is a significant premium to the IPO price of 291. The stock has since increased by approximately 46 per cent, even though it corrects periodically. Prices ranged between 52 weeks 380, 599 and 475 with a low between 02024 and 2026.

| Historical Data | Value |

| IPO Price | ₹291 |

| Listing Price | ₹363 |

| Current Price | ~₹530 |

| Overall Gain | ~46% |

| Recent Range | ₹475 – ₹599 |

Sona BLW Share Price Performance and Volatility

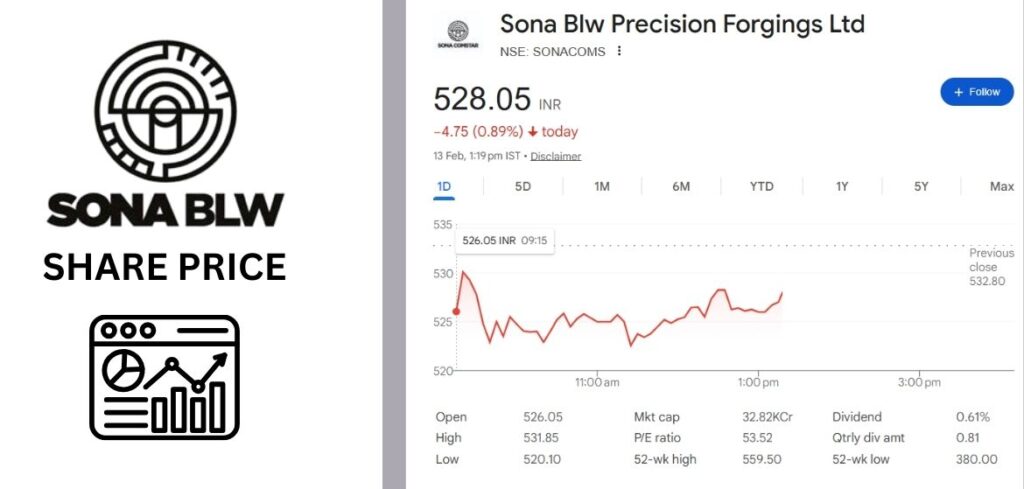

The share price of Sona BLW has been relatively volatile in the past one year. The stock has been fluctuating between 52-week high of evolving ₹560 and 52-week low of evolving 380, with alternating periods of optimism and market of EV growth and high-value and ownership turnover.

Although it has not experienced any long-term returns, the 1-year and 3-year returns of the stock have been positive by approximately 4 and 6 percent respectively, and the stock has been consolidating following a healthy rerating period in prior years.

| Parameter | Value |

| Current Price | ₹532 |

| 52-Week High | ₹560 |

| 52-Week Low | ₹380 |

| 1-Year Return | ~4% |

| 3-Year CAGR | ~6% |

Sona BLW Share Pride Valuation Analysis

Sona BLW has a price-to-earnings ratio of approximately 50.8 at present and that represents a large premium of the median of the auto components industry. This premium indicates market anticipations of high and continuous growth, technology dominance, and EV percolation. The value of the company by itself is 91.9, and the price to book ratio is approximately 5.8x, which is backed by the good profitability and efficiency of its assets. A dividend is also paid out by Sona BLW and the dividend yield is approximately 0.60, which balances the reinvestment and shareholder returns.

| Metric | Value |

| P/E Ratio | 50.8 |

| Book Value | ₹91.9 |

| Dividend Yield | 0.60% |

| ROCE | 17.8% |

| ROE | 14.4% |

Sona BLW Company Revenue Growth Trend

Sona BLW has recorded good top-line growth in the last couple of years. The increase in revenue was 20 times higher, namely 612 crore to 3,546 crore between FY18 and FY25 respectively and TTM revenue is 4,057 crore. This has been influenced by greater content by vehicle, growing EVs-based orders, and spreading relations with international OEMs.

The 5-year CAGR in company in terms of sales was 28, which demonstrates the capability of the company to expand faster than the industry in the auto components world.

| Period | Growth |

| 5-Year CAGR | 28% |

| 3-Year CAGR | 19% |

| TTM Growth | 14% |

Sona BLW Share Profit Growth Trend

Operating leverage, scale benefits and margin discipline have increased profit growth by a better percentage than revenue growth. The net profit increased 78 crore FY18 to 600 crore FY25, and TTM profit 606 crore. The company has attained a 5-year variation in profit CAGR of 31 which represents the steady execution and augmented contribution of the products with higher margins.

| Period | Growth |

| 5-Year CAGR | 31% |

| 3-Year CAGR | 19% |

| TTM Growth | 9% |

Sona BLW Share Price Quarterly Performance Analysis

The quarterly performance shows consistent demand and strong profitability. The revenue trends have stayed up with a slight variation in the operating margins which are good compared to the industry standards. In the December 2025 quarter 1200 crore in sales and 150 crore in net profit were recorded, with the support of constant operating margins of approximately 25.

| Quarter | Sales (₹ Cr) | Net Profit (₹ Cr) | OPM |

| Mar 2025 | 865 | 164 | 27% |

| Jun 2025 | 854 | 122 | 24% |

| Sep 2025 | 1,138 | 170 | 25% |

| Dec 2025 | 1,200 | 150 | 25% |

Sona BLW Company Margin Analysis

The operating margins of Sona BLW are also the highest in the auto components industry. Margins surged up to almost 30% in FY23 -FY24 and have since stabilised with volumes adjusted and costs adjusted accordingly. With moderation, margins are structurally robust, indicating product complexity facets, automation and discipline in pricing.

| Year | OPM |

| FY20 | 23% |

| FY22 | 26% |

| FY24 | 28% |

| FY25 | 27% |

| TTM | 25% |

Sona BLW Company Balance Sheet Strength

Over the years, the balance sheet of the company has been strengthened. The borrowings have decreased drastically leaving Sona BLW virtually debt free. Reserves have grown fast reaching 5000 crore and indicate retained earnings, capital discipline.

| Item | ₹ Cr |

| Total Assets | 6,537 |

| Reserves | 4,873 |

| Borrowings | 202 |

| Fixed Assets | 2,127 |

| Investments | 864 |

Sona BLW Company Cash Flow Analysis

Cash flows of operations have been either at par or have been increasing as compared to profits. These cash flows have been used to finance capital expenditure, acquisitions and dividend payment.

The cash flows of investing have been fluctuating because of growth and strategic investments and financing cash flows indicate the dividend disbursements and the infrequent equity-related funds flows.

| Year | CFO | CFI | CFF |

| FY23 | 533 | -562 | 19 |

| FY24 | 693 | -471 | -175 |

| FY25 | 775 | -1,762 | 1,944 |

Sona BLW Company Working Capital Efficiency

The efficiency of working capital has fallen in the past years. Days working capital went up to 118, and this was due to the growth in new receivables and inventory that were required to facilitate global growth and EV programs. Although this has not been taking a toll on cash flows as yet, it is one of the areas that need to be monitored.

| Metric | FY25 |

| Debtor Days | 73 |

| Inventory Days | 82 |

| Payable Days | 77 |

| Working Capital Days | 118 |

Sona BLW Company Return Ratios and Capital Efficiency

The returns ratios are also healthy but lesser than previous levels. ROCE stands at 17.8%, while ROE is 14.4%. The moderation indicates balance sheet growth and equity dilution as opposed to weakness in operations.

| Metric | Value |

| ROCE | 17.8% |

| ROE | 14.4% |

| 5-Year ROE Avg | 18% |

Sona BLW Company Shareholding Pattern Analysis

The level of promoter shareholding has decreased considerably in the last three years and is currently approximately 28. Conversely, this has seen domestic institutional investors (DIIs) gradually grow their ownership to more than 40 percent. In recent quarters, FIIs have not been that exposed.

This move implies rising institutional confidence and decreased promoter concentration.

| Category | Holding |

| Promoters | 28.02% |

| FIIs | 23.89% |

| DIIs | 40.74% |

| Public | 7.35% |

Conclusion

Sona BLW Precision Forgings is a technological based auto component company that can harmonize with the world trends of electrification. Its excellent growth track record, high margins, and growing EV exposure supports its high positioning. Nonetheless, high valuations, changes in ownership, and intensity of working capital present short-term risks.

The company is most appropriate to long-term investors who are not afraid of the volatility of valuation in exchange to participate in the global mobility transition.

FAQs

Sona BLW is a designer and manufacturer of automotive systems and components that are precise engineered such as the differential gears, traction motors, starter motors, and EV-related solutions in the drivetrain system.

Yes, Sona BLW has high exposure to electric and hybrid car platforms via its traction motors, BSG systems and EV-compatible components of their drive train.

The shares are trading at a premium because they have high growth in profits, operations, international relationships with OEMs and a portfolio that is focused on electrification and mobility technologies.

The company has an almost debt free status with drastically decreased borrowings and efficient operating cash flow upholding its balance sheet.

The main risks are valuation at high level, increasing working capital needs, and decreasing shareholding of promoters in the last years

Read More

Beyond Likes: Finding a Social Media Agency That Actually Delivers